The social cost of carbon dioxide recently put forward suggests a 14p and 12p uptick in excise duties per litre on diesel and petrol respectively, as was discussed during the Dublin Economic Workshop’s yearly conference this past Friday in Wexford. Edgar Morgenroth, a Dublin City University economist, pointed out environmental damage due to the release of an additional tonne of CO2, estimated at about €100. At present, the national carbon tax rate is set at €56 per tonne.

If this tax were increased to mirror the social cost, Mr. Morgenroth suggests the rise would significantly impact the excise duty on transport fuels. Based on a social cost of carbon of €100, an augmentation of 14p per litre of diesel and 12p per litre of petrol would be warranted for the carbon component of the mineral fuel tax, he articulated.

As the monetary value of environmental damage escalates, so must the cost of emission, Mr. Morgenroth informed attendees. The Government has sanctioned yearly ascensions to the carbon tax of about €7.50, til 2029, and €6.50 in 2030, when the rate should hit €100 per tonne of CO2.

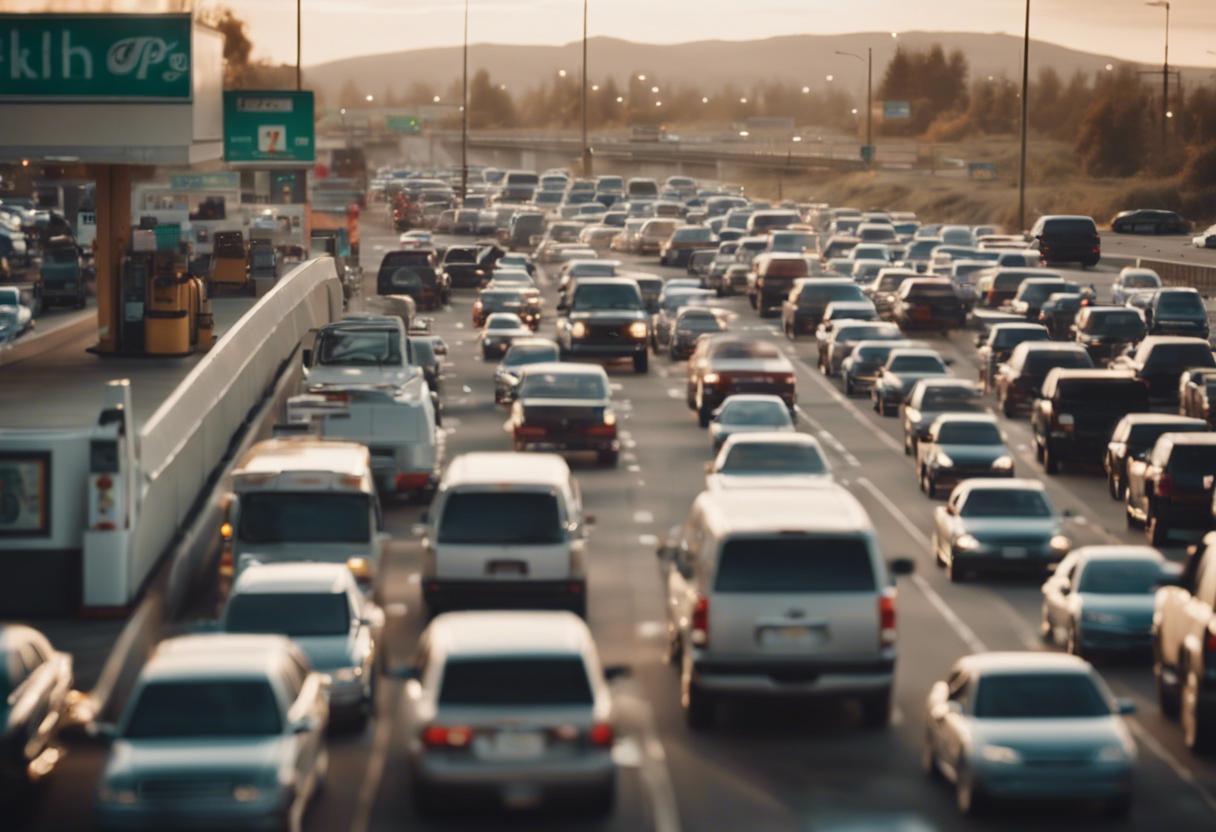

He encouraged a transition from ownership-based levies, like motor and vehicle registration taxes, to usage charges such as the current excise duty and potentially congestion charges, citing research showing their effectiveness in behavioural change. In its 2022 proclamation, The Commission on Taxation and Welfare supported introducing congestion charges in Dublin and other urban areas, similar to those already enforced in cities like London, Stockholm, and Milan.

The academic highlighted that carbon emissions were one of many social costs linked to driving, with the under-discussed damage to roads by vehicles being another contributor. He noted that tractors, despite representing merely 2% of the yearly mileage on Irish roads, cause sixfold more road damage than all the cars combined, and that’s assuming tractors are not carrying any load. Mr. Morgenroth remarked, “Roads get damaged by usage, but this is seldom addressed”.